How to register a corporation in the Philippines (including using the online process)

Registration with the SEC and other government agencies is required to form a corporation

A corporation is a legal entity composed of a group of people authorized and recognized by the state to conduct certain purposes or business activities.

It can initiate contracts, loan and borrow money, sue and be sued, hire employees, own assets, and pay taxes.

I discuss the following:

- What a corporation is,

- Its benefits and disadvantages

- The practical steps to incorporating in the Philippines;

The incorporation process is especially detailed and we discuss the step-by-step registration process which has both an online and offline component.

First, let’s define a “corporation”.

Contents

- What is a Corporation?

- How does a Corporation differ from a Cooperative?

- What are the advantages of a corporation?

- What are the disadvantages of a Corporation?

- Where do I register a Corporation?

- What are the Documentary requirements needed to register a corporation?

- What is the process to register a corporation?

- Requirements for obtaining the VAT or Non-VAT account number

- Requirements for the registration with BIR of books of accounts and accountable forms

What is a Corporation?

Corporations can be sued.

The Corporation Code of the Philippines (Batas Pambansa Bilang 68) is the governing law discussing the establishment and operation of stock and non-stock Philippine corporations.

The code gives the legal definition of a corporation. It discusses the 2 basic classifications of corporations, which can be a stock or a non-stock corporation. It also explains the share classifications, such as common stocks and preferred stocks.

A corporation is a business organization where owners (known as stockholders) have an undivided ownership share in the assets of the corporation upon its dissolution; and a share in its profits corresponding to the number of shares of stock which they own.

A subsequent law was passed revising BP. 68.

The Revised Corporation Code is Republic Act 11232. Signed on 21 February 2019, it amends the 38-year-old Corporation Code to improve the ease of doing business in the Philippines.

How does a Corporation differ from a Cooperative?

Cooperatives are very different from corporations.

Under the Presidential Decrees No. 175, a cooperative is defined as:

“… organizations composed primarily of small producers and consumers who voluntarily join together to form business enterprises which they themselves own, control and patronize.”

The Cooperative Code of the Philippines, Republic Act No. 6938, was created in 1990 and serves as the legal basis for the operation of all cooperatives in the country.

The differences are:

- A cooperative is organized for service while a corporation’s purpose is profit.

- Membership in a cooperative is open and voluntary while in a corporation, membership is restricted.

- In a cooperative, one man has one vote, with no proxy voting. In the case of a corporation, it is one share, one vote with more shares meaning, more votes.

- A cooperative’s profits are refunded to the members of a cooperative on the basis of their individual patronage, while corporate profits are distributed to stockholders on the basis of the number of shares.

Both corporations and cooperatives depend on business efficiency to survive in a competitive market. Their activities and operations are regulated and supervised by the government. They both enjoy a reasonable degree of economic freedom.

We will learn more about cooperative governance, membership to corporations and cooperatives, and shares and stocks, in forthcoming articles.

What are the advantages of a corporation?

There are several advantages to registering a corporation

The following are the advantages of a corporation:

- It has legal capacity. A corporation has a separate juridical personality and can enter into legal transactions.

- It has more or less permanent existence. The life span of a corporation is 50 years, subject to renewal for another 50 years. The death or withdrawal of some officers, stockholders, or members does not affect the life of the corporation.

- Management is centralized. The corporation’s management is centralized and guided by the provisions in the articles of incorporation. Management power is lodged with the board of directors or trustees. The board is the decision-making body of the corporation.

- It has the most efficient management. As it is governed by the Corporation Code of the Philippines, the creation, organization, management, and dissolution processes of a corporation are standardized, in spite of its huge resources and large-scale operation.

- Shareholders have limited liability. In case the corporation becomes bankrupt, only the capital contributions of the shareholders/members are affected. The stockholder’s personal properties are excluded from the financial claims of creditors of the corporation.

- Shareholder freedom. Shareholders are not general agents of the corporation and can transfer their shareholdings without the consent of other shareholders.

- Ability to raise more capital. It has the most effective means of raising capital for its operations such as through selling stocks and bonds. Stocks are certificates of ownership while bonds are certificates of indebtedness.

What are the disadvantages of a Corporation?

The major disadvantage of a corporation is that it is separately taxed.

- Complicated to maintain and not easy to organize. Aside from complying with capital requirements, there is a lot of paperwork involved in securing a registration. It also takes time for Securities and Exchange Commission (SEC) approval.

- Governmental intervention. It is subject to a lot of governmental control and supervision. It must file annual and/or quarterly reports.

- Subject to higher tax. It is subject to a higher income tax rate although this is gradually being lowered due to the corporate train law. See Income Tax directives here: https://www.bir.gov.ph/index.php/tax-information/income-tax.html)

- It has limited powers. A corporation is guided by the articles of incorporation. Its operations must stay within the activities allowed by its articles.

- There is a very impersonal or formal relationship between the officers and employees of a corporation. In sole-proprietorship and partnership, everybody knows everybody because it is a small enterprise. However, for corporations, it is possible that stockholders, as well as officers and directors, are not familiar with each other and their employees

Where do I register a Corporation?

Part of the corporation registration SEC can be done online

The registration process begins with registration at the SEC.

The whole process requires you to secure license and business permits from the local government unit and obtain a TIN and other documents from Bureau of Internal Revenue (BIR).

Here is the list of government agencies you’ll interact with to register a Philippine Corporation:

- Securities and Exchange Commission

- Local Government Units where your business is located:

- Barangay

- Mayor’s Office

- Bureau of Internal Revenue (BIR)

- If you have employees, you need to register to the following to comply with government mandated employee benefits:

- Social Security System (SSS)

- Philippine Health Insurance Corporation (PhilHealth)

Home Development Mutual Fund (PAG-IBIG Fund)

What are the Documentary requirements needed to register a corporation?

Gathering the initial requirements is time consuming

The initial documents required are:

- Name Reservation and Payment Form

The Name Reservation and the Payment Form is done through the SEC Company Registration System (https://crs.sec.gov.ph). This is the online process that verifies the company name and allows the payment of fees.

- Notarized Articles of Incorporation and By-laws

The SEC Company Registration System produces a proforma Articles of Incorporation and By-law. This may also be drafted by a lawyer. Don’t forget to get it notarized by a notary public.

Here is a sample Articles of Incorporation and By-Laws.

- Treasurer’s Affidavit

The corporate treasurer prepares this document and certifies the amounts subscribed and paid by the incorporators for stock corporations.

Here is a sample Treasurer’s Affidavit.

- Bank Certificate of Deposit or Proof of Inward Remittance

Once the Articles of Incorporation and By-laws are drafted, you need to open the Treasurer In Trust For (TITF) account with your preferred bank.

What is a TITF account?

A TITF account serves as the temporary depository account of the required paid-up capital of the corporation.

The TITF needs to be someone based in the Philippines, specifically within the locality of your bank. The Corporate Treasure and Treasure-In-Trust may or may not be the same person. The Treasurer-In-Trust is temporary and may be changed later on upon the completion of the process.

It is important to have multiple copies of the requirements

This is a requirement for registration.

You’ll need:

- The Articles of Incorporation and By-Laws

- A specimen signature card to be accomplished by the Treasure in Trust

- A valid identification card of the Treasurer in Trust

- The minimum initial deposit amount as required by your bank.

- Other requirements may be asked for by your bank

Upon the submission and approval of your TITF account, the bank will issue a Certificate of Deposit.

- Lease Agreement

You’ll need to have a corporate address and lease agreement.

The address will need to be placed in your Articles of Incorporation.

- Statement of Assets and Liabilities

This shows the financial health of a corporation.

- Duly accomplished SEC Form F-100

For corporations with more than 40% foreign equity, they must fulfill a SEC Form F-100 which is an Application to do Business under the Foreign Investment Act of 1991 (mandated by R.A. 7042).

R.A. 7042 allows only 40% of the capital stock outstanding and entitled to vote is owned and held by non-Filipinos (See: https://boi.gov.ph/r-a-7042-foreign-investments-act-of-1991/)

Here is a copy of SEC Form F-100.

What is the process to register a corporation?

Reading articles from the web beforehand or consulting a lawyer can help you complete the process smoothly

The extensive registration process will be fulfilled when these eight steps are completed.

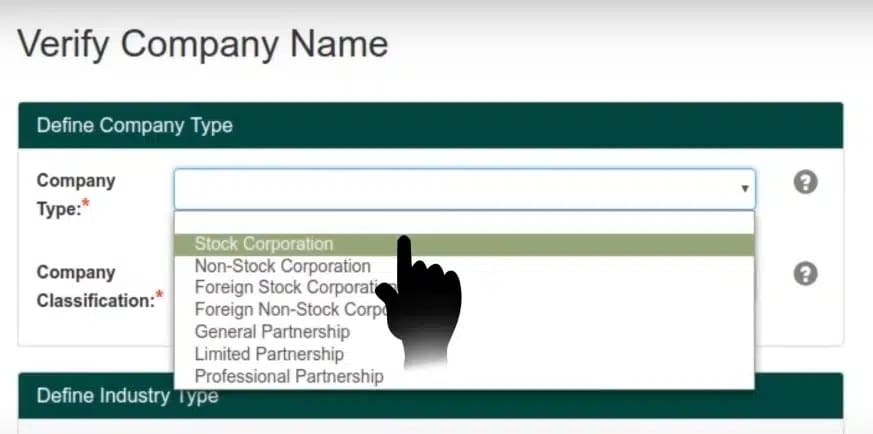

Step 1: Verification of corporate name with SEC via the SEC Company Registration System.

You must first sign up and log in at the SEC website to get to the Company Name verification page.

Begin the registration process by logging in to the SEC Company Registration System (https://crs.sec.gov.ph).

One of the initial requirements in the online form is the verification of corporate names.

You need to receive a “Company Name is available” notification to be able to proceed.

If there are similar names, you will not be allowed to move forward in the online form.

Step 2: Drafting and execution of the Articles of Incorporation with the assistance of competent legal counsel.

The Articles of Incorporation state the name and line of business or service activity of a company

The contents of the Articles of Incorporation can be found below.

Each of the incorporators and trustees is to sign the document.

When an incorporator or trustee resides abroad or is a foreigner, the document must be personally signed by the trustee along with copies of their passport and other pertinent documentation.

The incorporator or trustee must sign the articles of incorporation as the SEC does not accept electronic signatures or signatures on behalf of the person.

Other pertinent documents SEC requires include the VISA documents, birth certificates, and national identification cards of the foreign investor of your corporation.

The document must be apostilled or authenticated.

Step 3: Deposit of cash received for subscribed shares of stocks in a banking institution in the name of the temporary treasurer-in-trust-for account.

Before registration, the treasurer in trust of the company must have deposited to a bank

You must deposit the initially subscribed shares indicated in your Articles of Incorporation in a banking institution under a treasurer-in-trust-for account.

The certificate of deposit or deposit slip confirming the successful opening of a TITF account should be kept.

Take note that the bank will not allow you to start a corporate account under your corporation name at this point in the process as it has not yet received the SEC certificate of incorporation.

Step 4: Filling of the Articles of Incorporation at the SEC together with the following:

Requirements can be filed through an authorized representative.

- Treasurer’s affidavit

- Statement of assets and liabilities of the proposed corporation.

- Bank Certificate of Deposit of cash paid for subscription

- Personal information sheet of the incorporators which is autogenerated after completing the SEC Company Registration System.

Step 5: Payment of filing and publication fees. A payment form is generated after completing the SEC Company Registration System.

Even before pandemic, the SEC had started accepting cashless payments

The Payment system at SEC has been simplified for convenience through the SEC Payment Portal (https://www.sec.gov.ph/apps/payment-portal/home)

This is a three-part process.

- Secure a Payment Assessment Form (PAF) and Reference Number. The PAF and reference number is generated after the completion of the online SEC Company Registration System.

- Select Payment Option among the different available choices. Payment may be through

- over-the-counter payments at a SEC Office

- direct bank deposit at a Land Bank of the Philippines branch

- Through Paymaya. There may be bank fees and convenience fee charges

- Proceed to payment. Bring your PAF when paying at an SEC Office. Upon payment please keep your deposit slip or Paymaya payment receipt for verification later on.

Step 6: Issuance by SEC of the certificate of incorporation.

Releasing of the Certificate of Registration may be 10-15 days if there is no holiday (but this can depend)

SEC registration takes 15 to 20 working days upon submission of complete and correct documentary requirements, provided there are no

holidays.

Once there is an email notification from the SEC that your Certificate of Incorporation is ready, you may pick it up in the SEC office which you selected earlier in the SEC Company Registration system.

If you are not the one picking it up as the authorized representative of the company, a Special Power of Attorney (SPA) or authorization must be issued to the person authorized to obtain the documents and act on your behalf.

Step 7: Obtaining municipal licenses from the local government

You must secure a business permit and other papers as well as the Certificate of Registration before you can finally operate your business.

The process:

Go to your city hall and proceed to the Business Processing and Licensing Office (BPLO). Fill up the application form for new business.

Secure all documentary requirements, including the application form. Come back to the city hall when your documents are complete and pass the requirements at the BPLO.

Secure the payment form. Pay the fees at the cashier. Wait for the BPLO to inspect your business, this is called the zoning process.

Afterwhich, you will be notified when your business permit is ready for release. Come back to the BPLO office and secure your permit.

New Business Permit requirements are the following:

- Completely filled-up Application form for New Business (2 copies, Notarized)

The application form for a new business can be obtained from the Licensing and Permits office of your LGU.

- Original Barangay Business Clearance

Secure a Barangay Business Permit from the barangay hall where your business is located

- SEC Registration Certificate

- Lessor’s Permit (If Renting) or a Tax Declaration of Property (If Owned)

Step 7: Registration with the BIR

All companies must be registered with the BIR for tax purposes.

The process:

You need to physically visit the nearest BIR office. Pass the BIR Form 1903 (for VAT application) and 1905 (for Registration of books of account).

Attach all the documentary requirements with the relevant forms for processing. Secure the payment form. Pay the annual registration fee at the cashier.

Wait for the release of the Certificate of Registration (COR).

The BIR FORMS can be found here. The next two steps are fulfilled at the BIR:

Requirements for obtaining the VAT or Non-VAT account number

There are some company service activities that can be registered as Non-VAT

The registration with BIR of books of account are the following:

- BIR Form 1903 – Application for Registration for Corporations/ Partnerships (Taxable/Non-Taxable)

- Photocopy of SEC Certificate of Incorporation; or Photocopy of License to Do Business in the Philippines (in case of foreign corporation);

- Articles of Incorporation or Articles of Partnerships;

- Payment of P500.00 for Registration Fee and P30.00 for loose DST or Proof of Payment of Annual Registration Fee (ARF) (not applicable to those exempt from the imposition of ARF);

- BIR Printed Receipts/Invoices or Final & clear sample of Principal Receipts/ Invoices;

- Other documents for submission as applicable:

- Board Resolution indicating the name of the authorized representative or Secretary’s Certificate, in case of authorized representative who will transact with the Bureau;

- Franchise Documents (e.g. Certificate of Public Convenience) (for Common Carrier);

- Memorandum of Agreement (for JOINT VENTURE)

- Franchise Agreement;

- Certificate of Authority, if Barangay Micro Business Enterprises (BMBE) registered entity;

- Proof of Registration/Permit to Operate with BOI, BOI-ARMM, SBMA, BCDA, PEZA

More Information can be found here.

Requirements for the registration with BIR of books of accounts and accountable forms

You may be fined if you failed to register your books of accounts

The registration with BIR of books of account are the following:

- BIR Form 1903 – Application for Registration for Corporations/ Partnerships (Taxable/Non-Taxable)

- Photocopy of SEC Certificate of Incorporation; or Photocopy of License to Do Business in the Philippines (in case of foreign corporation);

- Articles of Incorporation or Articles of Partnerships;

- Payment of P500.00 for Registration Fee and P30.00 for loose DST or Proof of Payment of Annual Registration Fee (ARF) (not applicable to those exempt from the imposition of ARF);

- BIR Printed Receipts/Invoices or Final & clear sample of Principal Receipts/ Invoices;

- Other documents for submission as applicable:

- Board Resolution indicating the name of the authorized representative or Secretary’s Certificate, in case of authorized representative who will transact with the Bureau;

- Franchise Documents (e.g. Certificate of Public Convenience) (for Common Carrier);

- Memorandum of Agreement (for JOINT VENTURE)

- Franchise Agreement;

- Certificate of Authority, if Barangay Micro Business Enterprises (BMBE) registered entity;

- Proof of Registration/Permit to Operate with BOI, BOI-ARMM, SBMA, BCDA, PEZA

More Information can be found here.

0 Comments

Trackbacks/Pingbacks